RDNT Token

Token Information

RDNT token:

0x3082CC23568eA640225c2467653dB90e9250AaA0

RDNT/WETH Balancer LP:

0x32dF62dc3aEd2cD6224193052Ce665DC18165841

RDNT token:

0xd722E55C1d9D9fA0021A5215Cbb904b92B3dC5d4

RDNT/WETH Univ3 dynamic LP:

0x8A76639FE8e390Ed16eA88f87BEB46d6A5328254

RDNT token:

0xf7DE7E8A6bd59ED41a4b5fe50278b3B7f31384dF

RDNT/WBNB PancakeSwap LP:

0x346575fc7f07e6994d76199e41d13dc1575322e1

RDNT token:

0x137dDB47Ee24EaA998a535Ab00378d6BFa84F893

RDNT/WETH Balancer LP:

0xcF7b51ce5755513d4bE016b0e28D6EDEffa1d52a

RDNT, an OFT-20 token, is Radiant's native utility token. Layer Zero’ omnichain fungible token (OFT) interoperability solution enables native, cross-chain token transfers.

As voted in by Governance Proposal RFP-4, $RDNT emissions incentivize ecosystem participants to provide utility to the platform as dynamic liquidity providers (dLP).

Only users with locked dLP (liquidity tokens) activate eligibility for RDNT emissions on their deposits or borrows.

Additionally, dLP’s share in the utility of Platform Fees is captured in blue-chip assets such as Bitcoin, Ethereum, BNB, and stablecoins from borrowers paying loan interest, flash loans, and liquidation fees.

Through decentralized discussions, voting, and governance, the Radiant DAO has and always will dictate the decisions, and, ultimately, the vision of the Radiant ecosystem.

Liquidity Mining

Only users with locked Dynamic Liquidity (Liquidity Tokens) activate eligibility to receive RDNT emissions within the money market.

$RDNT Liquidity mining emissions can be instantly claimed for the total amount, provided they are zapped into locked dLP tokens by pairing the claimed $RDNT with wstETH/BNB.

Alternatively, emissions may be vested for three months. Vesting RDNT may be claimed early for an exit penalty to receive 10-75% of rewards, decaying linearly during the three-month vesting period.

Locking dLP tokens is a one to twelve-month process and must be re-locked after maturity to continue receiving platform fees.

For a detailed breakdown of how dynamic liquidity provisioning functions, visit the dLP section.

For a detailed breakdown of how Locking & Vesting work, visit the Manage Radiant section.

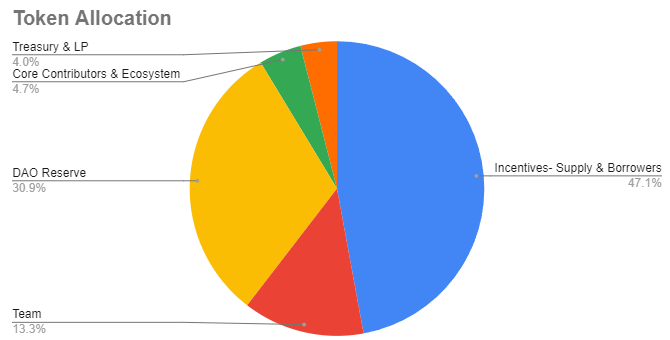

Genesis Token Allocation

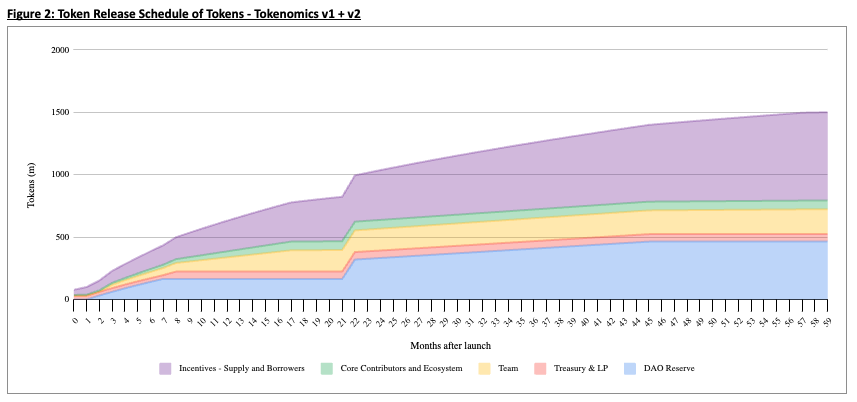

RDNT has a total supply of 1,500,000,000 tokens.

47.1% emitted as incentives for suppliers and borrowers, released over five years

13.3% to the team, released over five years, with a three-month cliff (10% of the team allocation is locked at the genesis of the protocol and unlocks at the 3-month cliff)

30.9% allocated to the Radiant DAO Reserve

4.7% allocated to core contributors and advisors, released over one and a half years

4% reserved for the Treasury & LP, ratified in RFP-9 governance proposal

RDNT Token Unlock Schedule

Last updated