Zapping dLP

Automated 1-click liquidity formation

What is Zapping?

Say you have ETH and want a position in the Balancer RDNT-ETH pool. Well, it’s a painful process to get into that position.

First, you must supply RDNT & ETH in the appropriate proportions, which takes four transactions.

Zapping allows you to do it in one click.

Which assets can be Zapped?

We've expanded zapping capabilities to make your experience more convenient. While previously only ETH could be used, now you can also zap into LP using additional assets.

ETH

BNB

ETH

ETH

USDC

USDC

USDC

USDC

USDT

USDT

RDNT

USDT

RDNT

RDNT

RDNT

How It Works

When you zap using one of these assets, the system will automatically sell it for ETH behind the scenes. This ETH is then paired with RDNT to create and lock the LP.

This feature aims to provide you with greater flexibility in how you engage with Radiant's money market, giving you more ways to earn and lock LP.

How to Zap via Radiant UI

First, connect your wallet to Radiant.

There are several areas on the platform to zap into dLP, but for the purposes of this tutorial, we will choose to zap from the Markets page.

You'll need one of our supported assets in your wallet to zap into LP. If you wish to borrow against your collateral, the Zap wizard supports that, as well.

Additionally, ensure you have the native gas token of the supported chain you're using—ETH for Arbitrum and BNB for BNB Chain—to cover transaction fees.

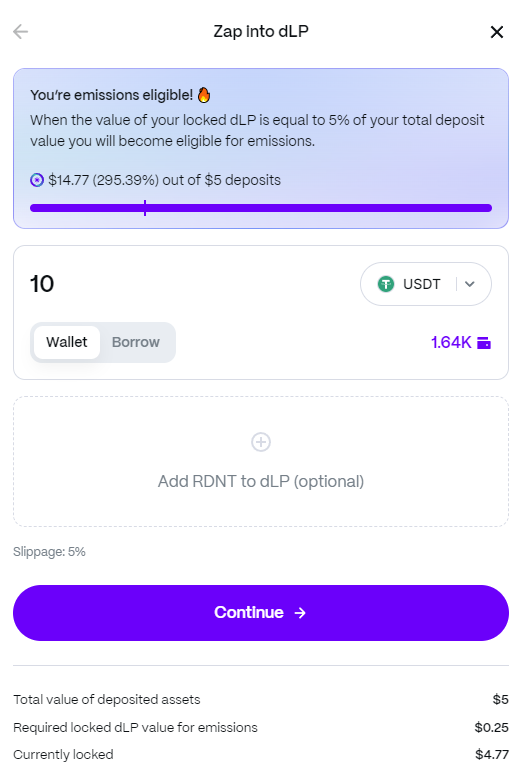

There is a minimum amount of $5 USD worth of dLP required to initiate a Zap.

Choose your Zap source. Radiant allows you to Zap with supported assets from your wallet. You can also borrow directly from the money market if you have deposited collateral. Please consider your health factor and risk of liquidation before borrowing. Zapping will never reduce your health factor below 1.1.

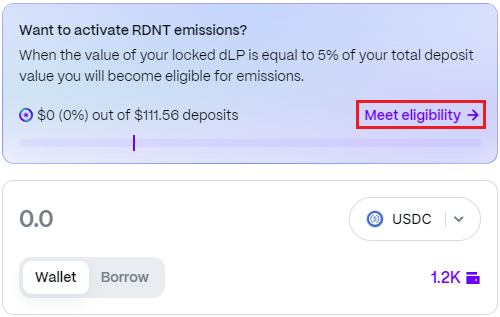

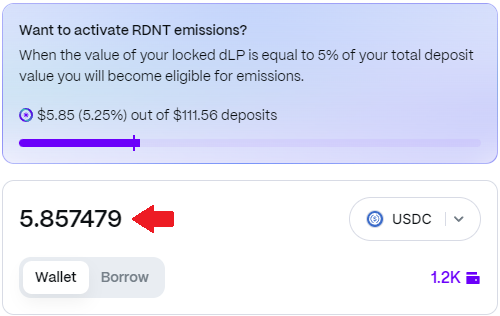

Input your desired amount. To quickly meet the 5% eligibility requirement for RDNT emissions, you can use the Meet eligibility button on the zap wizard for an auto-fill option. Of course, you can manually input the amount as well.

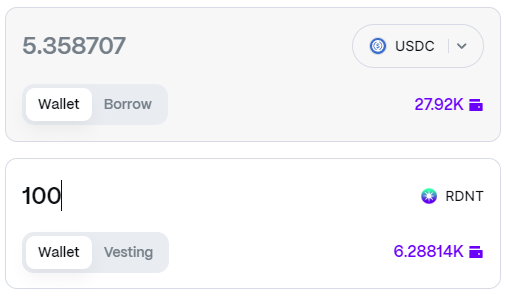

(Optional) Supplement with RDNT. If you wish to boost the dLP you're forming, you can add RDNT to the mix. The system will automatically calculate and fill in the amount of the primary asset required to create the pair. You can either supply RDNT directly from your wallet or use vesting RDNT without incurring any early-exit penalties. This step is entirely optional but can enhance the value of the dLP you're zapping and locking.

(Optional) Adjust Slippage. If you have a specific preference for slippage tolerance, click on the "Slippage" option in the Zap wizard. By default, it's set to 5%. Modify this percentage according to your risk tolerance. If the price changes unfavorably beyond this percentage, your transaction will automatically revert.

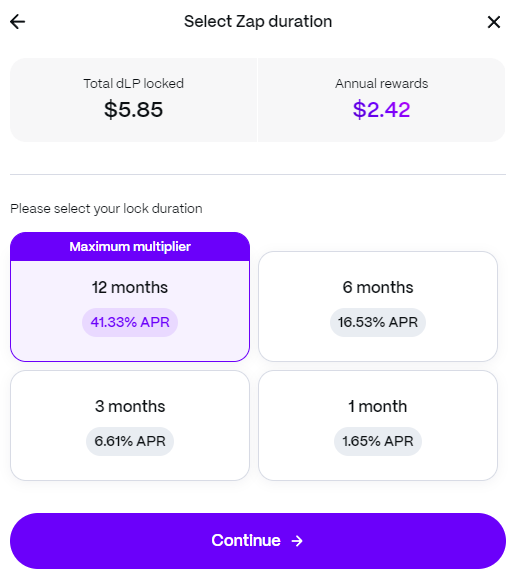

Select your Zap duration. The longer you lock, the higher the multiplier for your share of platform fees.

APR Calculations

Let's review how the locking APR is calculated for a locking duration of 1 month:

Example: 1 month locking APR: - Definition: Current locking APR for 1 month - Calculation: (Total 1 Month Lockers’ Share of Annualized Protocol Fees) / (Total 1 Month Lockers’ Share of dLP Pool Size) 1 Month Locker Share of Protocol Fees: -Calculation: (1 Month Locker Share of Protocol Power / Total Protocol Locking Power) Total Protocol Locking Power: - Calculation: (1 Month Lockers Share of dLP Pool Size * 1 Month Locker Multiplier (currently 1x)) + (3 Month Lockers’ Share of dLP Pool Size * 3 Month Locker Multipler (currently 4x)) + (6 month Lockers’ Share of dLP Pool Size * 6 month Lockers’ Multiplier (currently 10x)) + (12 month Lockers Share of dLP Pool Size * 12 Month Locker Multipler)) = Total Protocol Locking Power Your New Annual Rewards: - Definition: User projected annual rewards, in USD terms, based on both RDNT rewards and Protocol fees: -Calculation: (Projected user daily RDNT rewards * 365) + (Projected user daily protocol fees * 365)

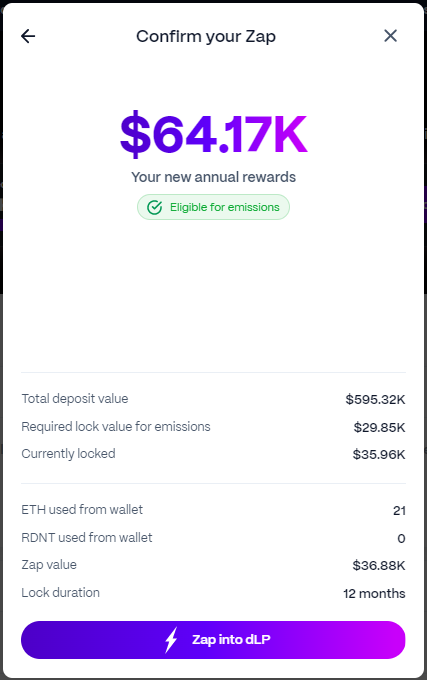

Confirm Your Zap

On this final step, a user can confirm their final zapping details. In the example shown, 21 ETH is being used from their wallet to zap into dLP. Our locking length is also displayed here.

Transaction Complete

Once the transaction is complete, you'll be a part of the liquidity pool and begin receiving platform fees!

Reminder, that zapping into dLP will lock your LP tokens for the specified time period (one to twelve months), and can be unlocked after that time period has elapsed. You may view your lock expirations from the Manage Radiant page.

Slippage and Other Risks

To manage slippage, click the little icon at the top right. Next, input your slippage tolerance and the maximum percentage you're willing to lose. Once you set your max tolerance for slippage, you're protected up to that amount. When you hit “Confirm” to execute a Zap, you will get an error telling you to reload the page or increase your slippage tolerance.

keep in mind that providing liquidity carries some risk, as the value of your LPs may fluctuate as well as impermanent loss.

Balancer explains the reduced impermanent loss in their Medium article, which applies to Radiant's dLP on Arbitrum.

Last updated